Following swiftly on the heels of a Thanksgiving that broke records with $4.2 billion in online sales, Black Friday also hit a new high, although it just fell short of predictions. According to analytics from Adobe, consumers spent $7.4 billion online yesterday buying goods online via computers, tablets and smartphones. The figures were up by $1.2 billion on Black Friday 2018, but they actually fell short of Adobe’s prediction for the day, which was $7.5 billion.

Salesforce, meanwhile, said that its checks revealed $7.2 billion in sales (even further off the forecast).

Popular products included toys on the themes of Frozen 2, L.O.L Surprise, and Paw Patrol. Best selling video games included FIFA 20, Madden 20, and Nintendo Switch. And top electronics, meanwhile, included Apple Laptops, Airpods, and Samsung TVs.

A full $2.9 billion of Black Friday sales happened on smartphones. These conversions are growing faster than online shopping overall, so we are now approaching a tipping point where soon smartphones might outweigh web-based purchases through computers.

“With Christmas now rapidly approaching, consumers increasingly jumped on their phones rather than standing in line,” said Taylor Schreiner, Principal Analyst & Head of Adobe Digital Insights, in a statement. “Even when shoppers went to stores, they were now buying nearly 41% more online before going to the store to pick up. As such, mobile represents a growing opportunity for smaller businesses to extend the support they see from consumers buying locally in-store on Small Business Saturday to the rest of the holiday season. Small Business Saturday will accelerate sales for those retailers who can offer unique products or services that the retail giants can’t provide.”

Adobe Analytics tracks sales in real-time for 80 of the top 100 US retailers, covering 55 million SKUs and some 1 trillion transactions during the holiday sales period. Salesforce uses Commerce Cloud data and insights covering more than half a billion global shoppers across more than 30 countries.

One of the reasons we may be seeing slightly less fervent sales than the analysts had predicted is because the holiday sales season is starting earlier and earlier. Black Friday, the day after Thanksgiving when many people have days off, has for a long time been seen by retailers as the start of holiday shopping season. That has changed as retailers hope to catch more sales over a longer period of time.

As more people shop, they are also shopping for more expensive items. Adobe noted that Average Order Value was $168, a new record level yesterday for Black Friday, up 5.9% on a year ago.

Smartphone sales were up 21% over last year and those who were not buying were, as a start, browsing, with whopping 61% of all online traffic to retailers coming from smartphones, up 15.8% since last year.

As with yesterday, e-commerce “giants” with over $1 billion in sales annually were doing better than smaller sites: they had more smartphone sales, and 66% conversions on browsers on smartphones, Adobe said. They have overall also seen a 62% boost in sales this season, versus 27% for smaller retailers.

As with the Thanksgiving sales patterns — when bigger retailers also appeared to do better than their smaller counterparts — there are a couple of reasons for this. One is that the bigger sites have a wider selection of goods and can afford to take hits with deep discounts on some items, in order to lure users in to add other items to their shopping cars that are not as deeply discounted. Or, bigger online retailers can simply afford to give bigger markdowns.

The other is that the bigger stores often have more flexible delivery options. Adobe noted that those using click-and-collect orders, or buy online, pick up in store / curbside grew by 43 percent.

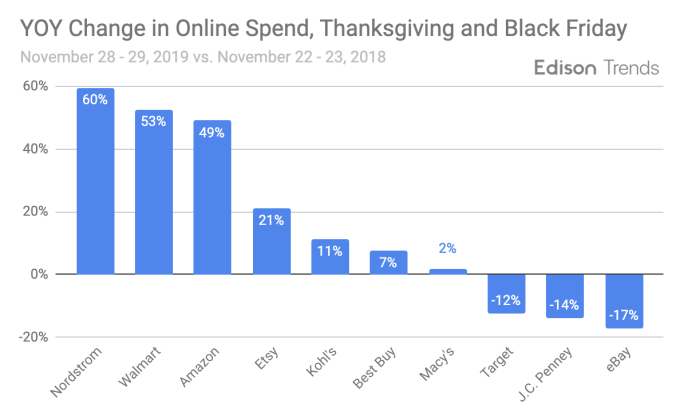

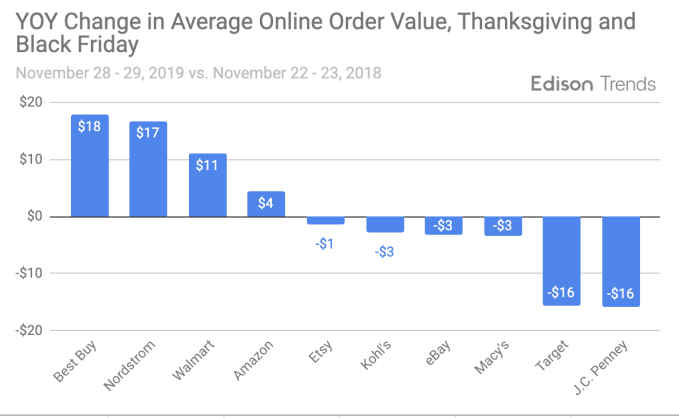

The story is not all rosy for big retailers, however. Edison Trends notes that some big platforms are actually seeing very mixed results this time around.

It will be interesting to see how and if patterns change for smaller retailers on Sunday, which is being dubbed “small business Sunday” to focus on buying from smaller and independent shops. Shoppers have already spent $470 million, and Adobe believes it will pass the $3 billion mark. Cyber Monday, the biggest of them all, is expected to make $9.4 billion in sales.

from TechCrunch https://ift.tt/2Y1PnAt

0 comments:

Post a Comment