Things were on the quiet side in robotland this week — and honestly, I don’t mind. It can hard to catch your breath covering the industry these days. But even a category as supercharged as robotics and automation has its occasional slow weeks — and late July/early August is as good a time as any to take a step back on how we’ve gotten here and where we’re going.

Quickly, a few of the macro trends I’m keeping an eye on in the coming weeks and months:

- I’ve been watching the CHIPS and Science Act over the past few weeks as it makes its way through Congress and onto the president’s desk. It was something Secretary Walsh was quick to bring up during our recent conversation, and robotics and automation firms are no doubt keeping a close eye on what impact it might ultimately have on domestic manufacturing.

- On the less fun side, it feels like we’re sitting here and waiting for the other shoe to drop amid economic woes and recession fears. If you follow Actuator, you’re keenly aware the industry hasn’t been immune to such activity, but for a category that’s so infamously difficult to succeed in, it’s been surprisingly resistant on the strength of huge investments driven by the pandemic. Just don’t be surprised if both investors and startups tighten their belts in the coming months.

- Going public in 2023? Locus Robotics recently mentioned its plans to IPO (still a rare thing among robotics cos — particularly through the more traditional route). Given the money and the interest that’s been floating around in recent years, I wouldn’t be surprised if more companies were eyeing one, but — at the very least — are waiting to see how some of the broader economic factors shake out.

- I’ve been seeing a lot of trend pieces from general interest news outlets about wide adoption of robotics in places like restaurants. That means we’re at the point in the cycle where we monitor how many places stick with these technologies. Too often these are the stories of a company looking for a little publicity jolt by experimenting with some new technology, only to decide after things die down that it doesn’t make much sense at scale.

Image Credits: Berkshire Grey

I will say, I think we’re at a point where we can say that automation is a lot more than a flash in the pan when it comes to warehouse and logistics. Lots of companies have found a lot of success here, and the labor shortage doesn’t look to be resolving itself any time soon. This week, FedEx and Berkshire Grey entered into a sizable deal that finds the logistics giant buying $200 million worth of robotics systems, in exchange for stock warrants. The news represents a nice rise in BG’s stock price after what’s been a really rough post-SPAC year.

Says FedEx Corporate VP Rebecca Yeung:

Our growing relationship with Berkshire Grey for robotic automation is a direct response to the growth of e-commerce, which has accelerated the demand for reliable automated solutions throughout all stages of the supply chain. FedEx believes that continued innovation and automation will improve efficiency, productivity and safety for its team members as they continue to keep the global supply chain moving.

Image Credits: Fanuc

Some positive growth news for Fanuc’s North American Wing, which sees the Japanese industrial robotics giant nearly doubling its presence in Michigan after opening a campus in late 2019. Once finished, it will add 788,000 square feet to the original 461,000.

Meanwhile Monarch this week announce that it will be building its autonomous tractors at Foxconn’s Lordstown, Ohio plant. The news follows its announcement of a retail expansion into India.

Image Credits: Polymath

Kirsten’s got news on the launch of Polymath Robotics, a new firm founded by Starky’s Stefan Seltz-Axmacher. That one starts with the evocative quote “robots suck.” I’d argue for a more nuanced “robots are less user-friendly than they ought to be,” but that’s a lot less punchy and probably a big part of the reason I’m attempting to survive in New York City on a journalist’s salary and not launching startups.

The firm is entering the lucrative field of user-friendly automation software. There’s a reason a lot of folks are trying to crack the code of hardware-agnostic, user-friendly robotics software. There’s a lot of money to be made for the company that can really stick the landing.

Image Credits: Ottonomy.IO

Looks like the funding hasn’t entirely dried up for last-mile delivery robots just yet. Ottonomy.IO just raised a $3.3 million seed round as it works toward wider deployment of its sidewalk ‘bots. Co-founder Ritukar Vijay naturally cited labor shortages as a driver here, telling TechCrunch, “One of the most important problems which we are trying to solve with these autonomous delivery robots is around labor shortages.”

Image Credits: Spread

Earlier this week I wrote about a sizable ~$30 million raise for Spread. The firm is possibly the best-known name in Japan’s growing vertical farming industry. As I noted, things started taking off in the space around 2011, when the tsunami that caused the Fukushima nuclear plant disaster left many in the country looking toward agricultural alternatives. I mention this here because robotics are a big part of Spread’s automated play, along with other leaders in the space.

Terabase Energy, meanwhile, just announced a $44 million Series B, co-led by Prelude Ventures and Bill Gates’ Breakthrough Energy. The round brings the Berkeley-based company’s total funding to $52 million. The company uses robotics to assist with the construction and operation of its photovoltaic power plants. It notes in a release:

Terabase’s automated field-factory, capable of 24/7 operations, can significantly compress construction schedules and reduce costs while ensuring higher build quality. The robotics-assisted workflow will also improve worker health and safety by eliminating manual lifting of heavy panels and steel components under often difficult outdoor weather conditions.

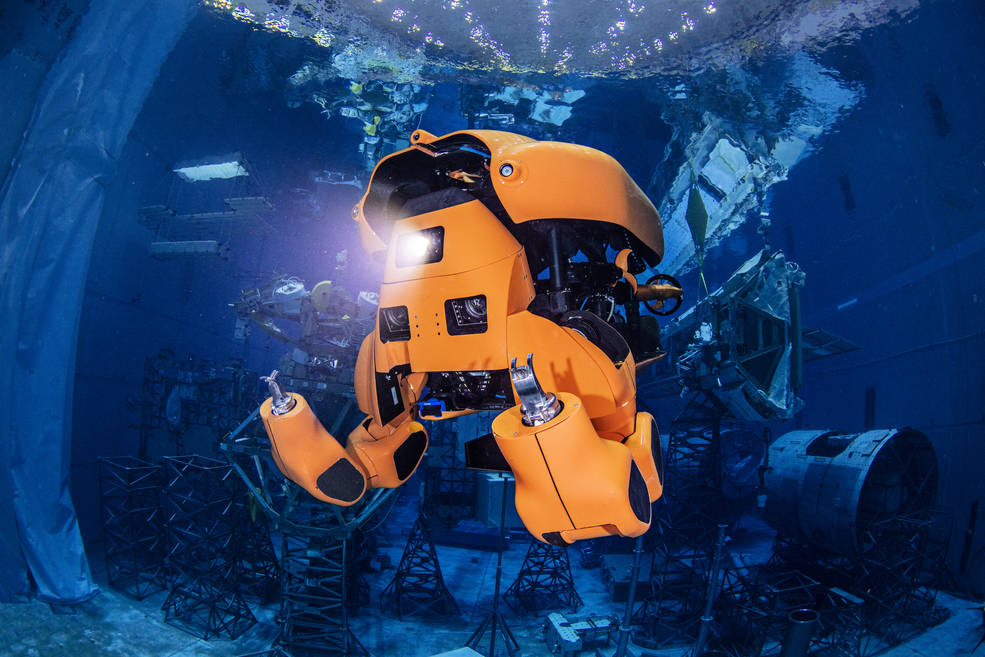

Image Credits: Nauticus Robotics

And finally, NASA this week detailed its work on a shapeshifting submersible system developed along with Houston-based Nauticus Robotics. Per NASA:

Bright orange, fully electric, and about the size of a sports car, Aquanaut, the company’s signature robot, resembles a propeller-driven torpedo as it motors to its destination. At that point, its shell pops open and the nose flips upward to reveal a suite of cameras and other sensors, now facing front. Two arms swing out, ending in claw hands that can be fitted with different tools.

Potential gigs for the robot include inspection of underwater equipment like wind turbines, maintenance of undersea cables and monitoring fish populations.

Image Credits: Bryce Durbin/TechCrunch

Come be under the sea in an Actuator garden.

from TechCrunch https://ift.tt/rZIQnPU

0 comments:

Post a Comment